How to make the most out of your 401(k)

Shutterstock / Shutterstock

Updated: December 27, 2023

You probably have a 401(k) at work. But are you making the most out of it? It could make a real difference when retirement rolls around

The problem is that millions of people contribute to an employer-sponsored retirement plan, but they do it without any overriding strategy. To the degree possible, that 401(k) strategy should always involve producing the largest plan balance by the time you reach retirement.

That can be even more important if you're forced into early retirement, either by a job elimination or even by an illness. The more you have in your plan at any given time, the better your future prospects will be.

But how do you make the most of your 401(k)?

1. Max out the employer matching contribution

This is advice we frequently give at Moneywise. If you're not sure how much to contribute to your plan, you should go with the minimum amount needed to get the maximum employer matching contribution.

For example, let's say you're 25 years old and your employer matches your contribution at 50% up to a maximum of 3% of your salary. To get the largest employer match, you’ll have to contribute at least 6% of your salary.

It can make a major difference in maximizing out your 401(k).

If you earn $100,000 per year, contributing 4%, your employer will match only 2%. That gives you a total contribution of 6% or $6,000 per year. Assuming a 7% average annual return on investment in a blended portfolio of stocks and bonds, by age 65 you’ll have $1,242,000.

But if you contribute 6% of your pay instead, you'll get the maximum 3% match from your employer. That will give you a 9% annual contribution, or $9,000 per year. By age 65, once again assuming a 7% average annual rate of return on investment, you'll have $1,864,000 saved in your plan.

That’s a 50% increase in your plan value just based on increasing your own plan contribution from 4% per year to 6%. It's a relatively minor change that can produce big results.

2. Max out your annual 401(k) contribution

It's possible that early in your career you locked into a percentage-based contribution. But early in life, with money being tight, that percentage might have been very low. For example, you may have contributed no more than 3% or 5% of your salary to the plan.

But did you know that retirement plan contributions are generally not restricted by a percentage? In theory, at least, you can contribute up to 100% of your income up to the maximum allowable contribution for the plan.

For 2024, the base amount is increasing to $23,000. If you're 50 or older, the maximum contribution you can make is $30,500 (with the $7,500 catch-up contribution).

Now, if you're earning $100,000, and still contributing 5%, that's just $5,000 per year. You'll be leaving $17,500 in contributions out of the plan every year.

Let's look at an example of what you're giving up with a low percentage contribution.

Let's say you're averaging a 7% annual return on your plan. If you began contributing to your plan at age 25, and expect to retire at 65, with an average annual contribution of $5,000, you'll save up just over $1 million ($1,035,655 to be exact).

But let’s say instead you max out your contribution each year, and have an average of $22,500, also with a 7% annual return. By the time you reach 65, you'll have $4,634,000.

That's over four times as much money. Now it's possible that will exceed your goal by age 65. But if you're forced into early retirement at 55 or 60, you'll really appreciate having made the larger contributions.

Maxing out your contribution and the effect on your employer matching contribution

If your employer offers a matching contribution, maxing-out your annual contribution can provide an additional windfall from the higher employer match.

For example, let’s say your employer matches 50% of your contribution up to 10%. You make a 10% contribution, then the employer will add 5%. That will happen automatically if you're maxing-out your own contribution.

Reflecting that in the same example carried from above, not only will you have an $22,500 contribution from your own pay, but your employer will fork over another $1,125 year. That will be equal to a 50% match on the first 10% you contribute your plan.

It will raise your annual contribution to $23,625. Assuming the same 7% return on your investment, by age 65 your total plan value will be $4,866,000.

As a result of the higher employer match on your higher contributions, your plan will be worth just over $1 million more.

3. Make the most of your investment funds

This gets to the management of your retirement plan. Unfortunately, most plan holders have relatively little investment experience or knowledge. What's more, very few plans provide investment management.

Employees often assume that since a retirement plan is provided by the employer, it's also somehow managed by either the employer or the plan administrator. Unfortunately, that's not usually the case.

At best, you'll be offered a plan that invests in various funds. You may be given a choice as to how much of your contributions will be allocated to those funds. You may be given a choice of several diversified funds, that represent the S&P 500, small-cap stocks, foreign stocks, emerging stocks, corporate bonds, government securities, and a cash equivalent account.

You'll often be asked to set the allocation when you first begin participating in the plan. That's a complicated task, especially when you're young and just starting out. You might choose an arbitrary mix, such as allocating 10% of your contribution to each of 10 different funds.

Or, to keep it simple, you might put all your contributions into a single fund or two. For example, you might put 60% of your money into an S&P 500 fund and 40% in cash.

But how do you know if that allocation is right for you?

Most employees don't. They opt for what seems right at the time, or just simply throw a dart and hope it all works out.

Unfortunately, guessing when it comes to retirement plan investment allocations can seriously hurt the performance of your plan.

How the mix of funds in your plan affects the final value

So far we've been giving examples of retirement plan values based on an average annual rate of return of 7%. But what – if due to poor fund choices – your average return is just 4%?

Let's go back to the example of maxing out your contributions at $22,500 per year in the first section. With that 7% return, your portfolio be worth well over $4.5 Million.

But at 4%, the final value drops down to just $2,177,000. That’s a difference of over $2 million!

And it all happened because you selected the wrong mix of funds in your plan at the very beginning.

How to make the most out of your 401(k) plan by getting professional help

Few employees are aware of that 401(k) strategy management assistance is available. There’s a 401(k) plan management service – that works just as well with 403(b), 401(a), 457 and TSP plans – that can manage your retirement plan for you.

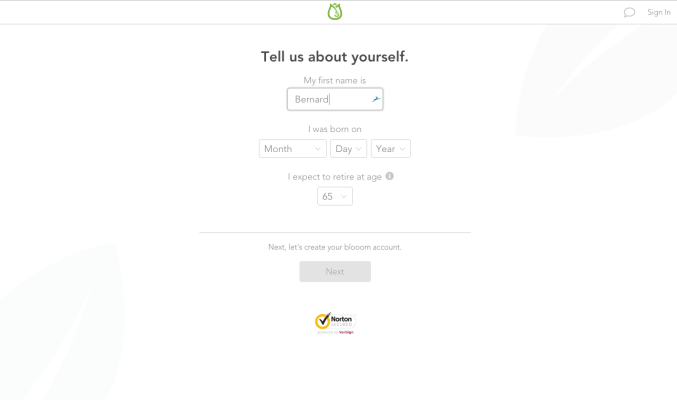

It’s called Blooom (yes, with three “o”s). Much like a robo-advisor, it can manage your retirement plan for you. You don't even need the approval of your employer or your retirement plan administrator to use Blooom to manage your account. Nor do you have to move your plan from where it is.

Blooom manages your plan wherever it’s at and works with the investments offered by your plan.

The app works to improve your investment performance in two primary ways:

- 1 It analyzes the funds in your plan and determines the actual fees you are paying for those funds. It then recommends lower-cost alternatives if they're available in your plan.

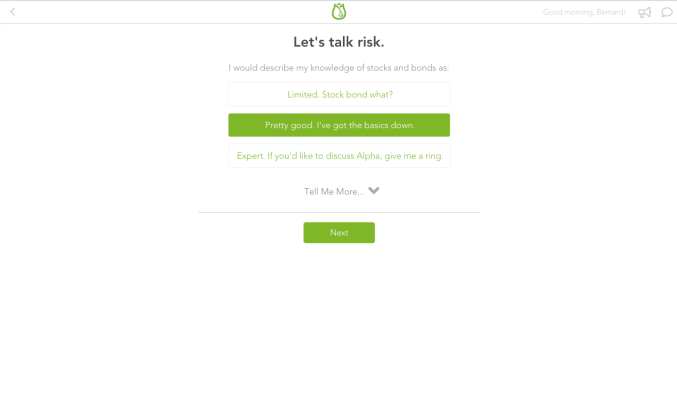

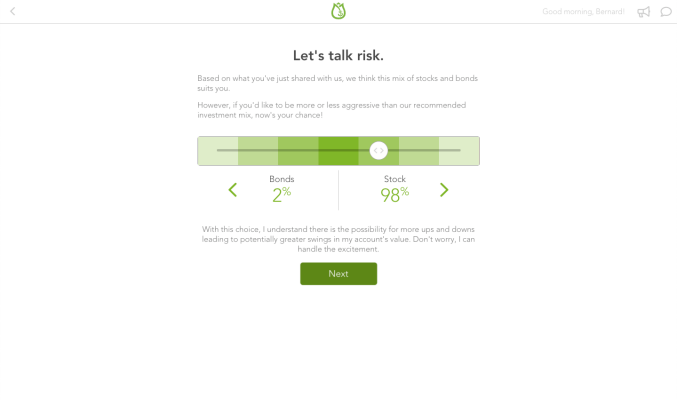

- 2 It establishes an asset allocation in your plan that's based on both your risk tolerance and your time horizon until retirement.

Let's look at both these services in more detail.

Analyzing fund fees

Since investing in funds has become common in retirement plans, the expenses charged by those funds is important.

It's not just fund fees, either. Some plans may also offer account management with fees most likely charged on the assets on the account, which becomes unnecessary to pay if you're working with Blooom. And perhaps more important, Blooom moves you out of target date funds. These have become quite common in recent years, being billed as the magic bullet for retirement planning.

But while target-date funds may have some value, they can come with very high fees. The same results could be achieved but without paying those high fees.

Once again, taking the example of maxing out your contributions at $18,500 per year with a 7% return, your portfolio will be worth well over $4.6 million.

But let’s say due to hidden fees, your actual return is just 6.5%. The value of your retirement plan at 65 could fall to $4,068,000.

That’s a difference of $600,000, owing to paying fees you didn't even know existed.

A service like Blooom may be worth having just for the possible expense reduction alone.

But fund allocation and management could yield even bigger results for some.

Screenshots

Creating the right asset allocation with the right funds

We gave the example above of the difference between a retirement plan with an investment return of 7% compared with one with 4%. Unfortunately, the 4% result is much more typical of self-managed plans.

Blooom will create a fund allocation designed to optimize long-term returns for an appropriate level of risk, based on your age and risk tolerance. The service will do this by having you more aggressively invested early in your life, which will mean greater exposure to equities. But as you move closer to retirement, Blooom will automatically shift your allocation into more conservative assets, like bond funds.

Many retirement plan owners aren't even familiar with this type of retirement investing. Not only does Blooom make this adjustment as you move toward retirement, but it also fully manages your retirement portfolio continuously. The app will rebalance your asset allocation as your portfolio changes.

Rebalancing in declining markets. Blooom monitors your investments and the exact allocations to each fund as they move up and down in value. When things stray too far from the target allocation Blooom recommends, a rebalance will be triggered to get the allocation back in line with your long-term strategy. The rebalance process Blooom uses essentially allows it to buy low on the investments that have dropped in value and sell high on those that have gained.

Company stock. Blooom recommends clients hold no more than 10% of their total portfolio in company stock.

You can rest comfortably, knowing your retirement plan is in good hands with professional management.

Take Blooom for a test drive

You can find out what Blooom is all about in just a few minutes of your time, and at no cost.

Blooom offers a free version that provides an analysis of your plan. That analysis will perform the following services:

- Uncover hidden investment fees.

- See what you're invested in.

- Give recommendations for stock and bond allocations to help you achieve your retirement goals.

This will give you an opportunity to see exactly what Blooom can do for your retirement plan. And while it's helpful to get a one-time analysis, managing a retirement plan is a lifelong responsibility. If you decide you don't want to handle it, and you prefer having professional management, Blooom can handle it for you for just $120 per year.

We've discussed the complications of managing a retirement plan, specifically relating to high investment fees and having the wrong allocation of funds. Getting this wrong can be a costly mistake.

You can avoid that outcome for no more than $120 per year. On a retirement plan worth $100,000, that works out to be an annual management fee of just 0.12%.

Is getting your retirement plan right worth at least that much?

Larry Ludwig is a freelance contributor for Moneywise.

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.