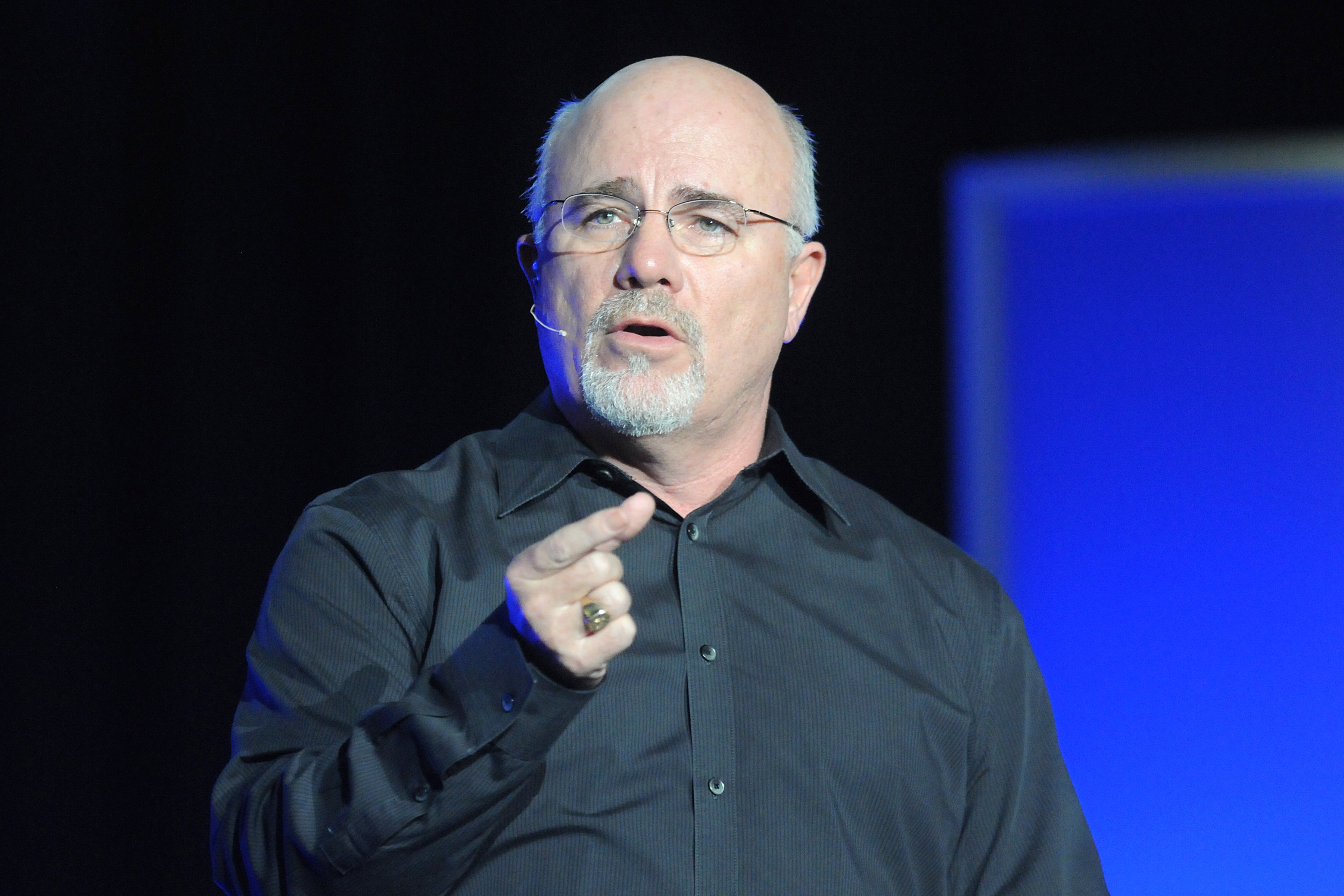

Dave Ramsey's net worth:

As of the most recent data available, Dave Ramsey’s net worth is estimated to be $200 million.1

Dave Ramsey is one of the most famous financial commentators in the country, and his media empire has made him a lot of money, with his radio and podcast alone attracting 20 million weekly listeners.

Much of his wealth is tied up in real estate and other assets that aren’t public or regularly valued, so determining his net worth can be difficult and is based on what information is publicly available as well as estimations based on the worth of his business, and is commonly estimated to be around $200 million.2

How did Dave Ramsey make his fortune?

Much of Ramsey’s net worth can be attributed to his real estate investments. Ramsey’s passion for flipping properties probably comes from his parents, who were both real estate agents. When he was 19, he took his real estate exam and got in on the action.3

Ramsey doesn’t publicly disclose the specifics of his real estate holdings but has said he owns commercial properties and 15 to 20 houses. All of these properties were purchased with cash and are debt-free.4

He also generates substantial figures from his media empire. Ramsey has authored several bestselling books and continues to collect royalties on them. In addition, he makes money from courses, speaking engagements, and his nationally syndicated radio program, the Ramsey Show, which reportedly brings in millions of dollars in advertising revenue.5

The value of Ramsey’s stocks and shares portfolio is presumably quite high, too. The personal finance guru regularly preaches about the importance of regularly investing money in mutual funds via tax-advantaged retirement accounts.

Dave Ramsey’s holdings

Dave Ramsey’s investment portfolio mainly consists of debt-free real estate and mutual funds.

During his 20s, Ramsey made a fortune flipping properties, but ended up borrowing too much and going bankrupt. That negative experience didn’t put Ramsey off real estate investing. It simply changed how he does it.6 Today, Ramsey only acquires properties without mortgages and debt financing. During a recent interview on his podcast, he claimed to “own 15 to 20 houses and a bunch of commercial real estate.”

Ramsey is also big on mutual funds. He strongly discourages people from picking individual stocks or chasing trendy investments. In his view, the most reliable way to build wealth over the long term is to place your eggs in many baskets and leave the buying and selling decisions to the experts.7

It’s not clear exactly which specific funds Ramsey has in his personal portfolio. However, he has spoken at length about the ideal portfolio being broken down in the following way:

Arrived Homes has gained traction—partly thanks to backing from Amazon’s Jeff Bezos—but it’s also standing out on its own merits. The platform offers a user-friendly interface and lets retail investors buy fractional shares in vacation rentals and single-family homes across multiple U.S. states, with minimum investments starting at just $100.

Though newer than some competitors, Arrived holds BBB accreditation, has distributed $12 million in dividends, and facilitated nearly $250 million in property investments. It's particularly appealing to investors looking for a simple, flexible way to handpick individual real estate assets.

Salary info

Dave Ramsey’s salary is not in the public domain, which means it must be estimated based on the most accessible financial figures.

Ramsey has various income streams, some of which fluctuate. One of his biggest earners is his podcast. According to Hello Audio, Ramsey is the third highest-paid podcaster, with the Ramsey Show generating approximately $10 million annually.8 The personal finance guru is also said to earn up to $300,000 for public speaking at financial workshops and conferences and several million dollars each year from book sales.9

Ramsey presumably nets substantial earnings from subscription services and referrals, plus his large investment portfolio. This includes real estate and funds that likely pay out in the form of rent and dividends, with possible reinvestment.

Key milestones in career

Here are some of the key milestones in Ramsey's work life and the years they occurred.

- 1972/73. When Ramsey was 12, he asked his dad for money to buy a popsicle. His dad responded that he needed a job, not money, prompting Ramsey to find his inner entrepreneur and start his first business mowing neighbors' lawns.

- 1988. After making millions from real estate, Ramsey was forced to file for bankruptcy. He took on a lot of debt to make his investments, and when the banks asked for repayment he couldn’t cover the bill. This dark moment for Ramsey reshaped his view on money and debt and paved the way for his trademark “no debt” philosophy.

- 1992. Ramsey self-publishes his first book, "Financial Peace." It became a hit and put him on the map as a personal finance commentator. During that same year, he also started a local radio show in Nashville and founded his media and education company Ramsey Solutions, which began as a small financial counseling service.

- 2003. The Total Money Makeover, Ramsey’s biggest bestseller, is published.

- 2015. The Ramsey Solutions headquarters is opened in Franklin, Tennessee, marking Ramsey’s transition from a solo financial expert to the leader of a media empire.

Investment strategies

Ramsey’s investing strategy is laid out in several steps on his website.

He first recommends getting out of debt — meaning only owing money on the place you live — then building an emergency fund covering three to six months of expenses. Only once this is achieved does he advise people to start investing.10

Ramsey’s investment strategy involves investing 15% of income each month in mutual funds via tax-advantaged retirement accounts. He’s big on diversification and strictly against picking individual stocks.11

Ramsey also believes in spreading risk by investing an equal amount in four different funds. He recommends splitting allocated investment capital into quarterly chunks:12

- 25% in a fund targeting growth

- 25% in a fund focused on growth and income

- 25% in funds invested in small companies with lots of upside

- 25% in funds specializing in non-U.S. stocks

Ramsey doesn’t explicitly name his top holdings but has name-dropped several funds in the past, including S&P 500 tracker funds and the New Perspective Fund.

Another one of Ramsey’s key investment principles is to be patient and hold on for the long term. He doesn’t believe in chopping and changing investments.

About Dave Ramsey: Personal life and history

- Age: 64

- Title: Founder and CEO of Ramsey Solutions

- Income source: Speaking, events, books, courses and investing in mutual funds and real estate

- Location: Nashville, Tennessee

Dave Ramsey’s personal life heavily influenced his money management philosophies.

Ramsey’s strong work ethic came from his parents, and his dad pushed him to start working when he was 12. This prompted Ramsey to come up with creative ways to make money.13

During and after getting a degree in finance and real estate at the University of Tennessee, Ramsey borrowed heavily to invest in real estate. His subsequent bankruptcy changed how he viewed money, strengthened his faith in Christianity, and was responsible for most of the financial principles he preaches today.14

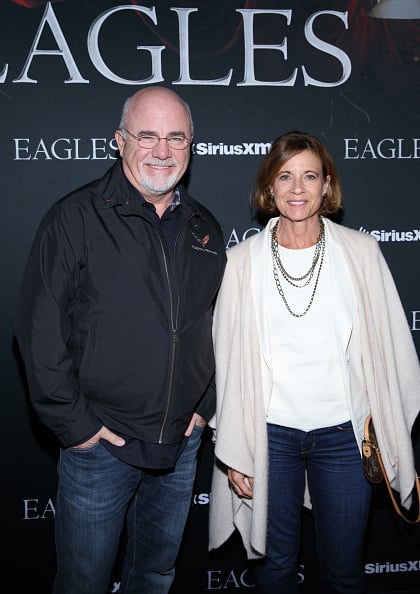

Family also serves as a model in Ramsey’s teachings. Ramsey often talks about the importance of a strong marriage for making better financial decisions. He has been married to his wife, Sharon, since 1982 and has three children. One of them, Rachel Cruze, works under the Ramsey brand and is a bestselling author and speaker.15

Ramsey’s theories aren’t appreciated by everyone, however. Common complaints include his no-debt rule being so rigid that it makes it harder for lower-income people to build wealth.16 Ramsey’s workplace policies have also come under fire: There have been allegations of employees getting fired for having non-Christian views.17

Daniel Liberto is a financial journalist with over 10 years of experience covering markets, investing, and the economy. He writes for global publications and specializes in making complex financial topics clear and accessible to all readers.

Disclaimer

The content provided on Moneywise is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter. Advertisers are not responsible for the content of this site, including any editorials or reviews that may appear on this site. For complete and current information on any advertiser product, please visit their website.

†Terms and Conditions apply.